How To Finance Your Florida Investment Property?

Investing in real estate can be a lucrative opportunity, and Florida, with its thriving market, makes it an attractive option for both seasoned investors and newcomers. However, before you start purchasing properties in the Sunshine State, one of the most crucial factors to consider is financing. How you finance your investment property in Florida can significantly impact your cash flow, profitability, and long-term success. This guide will walk you through the various options available for financing Florida investment properties, while addressing key aspects such as loan types, eligibility, and additional considerations.

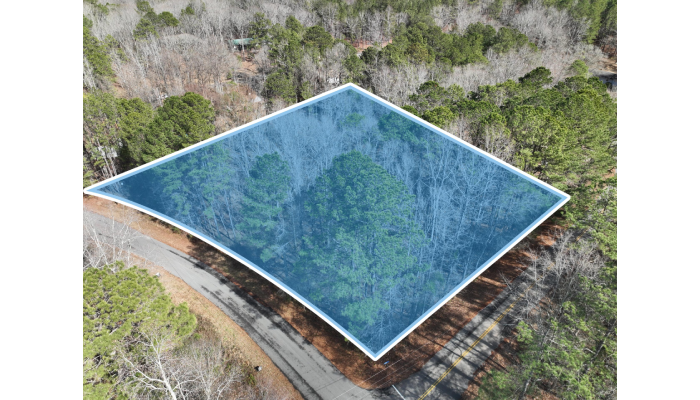

Understanding the Florida Real Estate Market

Before delving into the investment properties Florida, it’s essential to understand why Florida is such an attractive market for investment properties. The state is known for its strong economy, tourism industry, and population growth, all of which contribute to the real estate boom. Florida also has a variety of regions with different investment opportunities — from beachfront condos in Miami to vacation homes in Orlando, or multi-family units in Jacksonville.

The high demand for rental properties, particularly from tourists and seasonal residents, creates a stable income potential for investors. However, this dynamic market also means that property prices can fluctuate, making it crucial to secure financing that works in your favour.

Exploring Financing Options for Florida Investment Properties

When it comes to financing investment properties in Florida, several options are available. The best option depends on your financial situation, credit score, investment goals, and the type of property you’re purchasing.

Conventional Mortgages

A conventional mortgage is one of the most common types of financing for investment properties. This option typically requires a down payment of at least 20%, and the interest rates are determined by your credit score and other factors. For those with excellent credit, conventional mortgages may offer competitive rates, which can help keep monthly payments lower.

However, keep in mind that lenders typically view investment properties as riskier than primary residences. As a result, the interest rates may be slightly higher, and the loan approval process may be more stringent compared to a home loan for personal use. For long-term investors looking for a stable, traditional option, a conventional mortgage is often the best choice.

FHA Loans

While Federal Housing Administration (FHA) loans are generally used for primary residences, some investors may qualify for an FHA loan to purchase an investment property, provided they live in one of the units (in the case of multi-family properties). FHA loans come with lower down payment requirements (as low as 3.5%) and more lenient credit score criteria, making them a good option for first-time real estate investors.

However, FHA loans are only available for properties with up to four units. Additionally, the property must be owner-occupied for at least one year. Therefore, if you’re looking to invest in larger properties or if you do not plan on living in the property, this may not be the best option for you.

Hard Money Loans

Hard money loans are short-term loans secured by the property itself rather than the borrower’s creditworthiness. These loans are typically offered by private investors or companies, and they’re ideal for investors who need quick financing or are looking for a fix-and-flip property.

The main advantage of hard money loans is their speed — you can often secure financing in as little as a few days. However, they come with higher interest rates and shorter repayment terms, typically between 6 months to 3 years. They can be an excellent option for investors looking to quickly renovate and resell a property but are not ideal for long-term investments due to their high costs.

Portfolio Loans

A portfolio loan is a type of loan that is offered by banks or lenders that keep the loan on their books, rather than selling it to other financial institutions. These loans are more flexible than conventional loans, making them a good choice for investors who are looking to buy multiple properties.

Because the lender keeps the loan, they have more discretion when it comes to approval, making it easier for investors with less-than-perfect credit or those looking to finance multiple investment properties in Florida to secure funding. However, these loans typically come with higher interest rates than conventional loans, so they may not always be the most cost-effective choice.

VA Loans

If you’re a veteran or active military member, you may qualify for a VA loan, which offers several advantages, including no down payment and competitive interest rates. VA loans are primarily intended for primary residences, but you can use them to purchase a multi-unit property as long as you occupy one of the units.

While this financing option can be very attractive, it has limitations in terms of property type and occupancy requirements, which can make it less flexible for investors who are looking to buy non-owner-occupied investment properties.

Key Eligibility Requirements for Financing Florida Investment Properties

Regardless of the financing option you choose, lenders will assess certain criteria to determine your eligibility for a loan. Some of the key factors include:

Credit Score

Lenders use your credit score as a major factor in determining the interest rate and loan terms. Typically, a credit score of at least 620 is required for conventional loans, but the higher your credit score, the more favorable the loan terms. For investment properties, lenders may prefer a credit score of 700 or higher.

Down Payment

The down payment requirement varies depending on the type of loan you’re applying for. Conventional loans typically require at least 20% down, while FHA loans may require as little as 3.5%. Hard money loans, on the other hand, may require higher down payments due to the increased risk they present to lenders.

Debt-to-Income Ratio (DTI)

Lenders will also examine your debt-to-income ratio, which compares your monthly debt obligations to your income. For investment properties, lenders usually prefer a DTI of 36% or lower. A higher DTI can be seen as a risk, potentially making it harder to secure financing.

Property Type

The type of property you’re purchasing plays a significant role in financing. Single-family homes, multi-family properties, vacation rentals, and condos all have different requirements. For example, vacation rentals might have stricter lending guidelines because they are considered a higher risk for lenders due to their seasonal income nature.

Other Financing Considerations

Interest Rates and Terms

Interest rates and loan terms can significantly impact your investment. A higher interest rate can increase your monthly payments, affecting cash flow and the potential profitability of your investment. Always shop around for the best rates, and consider fixed vs. adjustable-rate loans, as well as loan terms, to find what works best for your financial goals.

Property Management and Rental Income

If your goal is to rent out your Florida investment property, lenders may require proof of the potential rental income. Many lenders will expect a projected income statement that shows how much you can expect to earn from the property each month. Additionally, they may want to ensure that the rental income will cover mortgage payments and other expenses.

Conclusion

Financing your Florida investment property requires careful planning and understanding of the various options available to you. Whether you choose a conventional loan, hard money loan, or portfolio loan, ensure that you select a financing method that aligns with your investment strategy, risk tolerance, and long-term financial goals.

Take the time to research and compare loan options, seek advice from professionals, and evaluate your personal financial situation. With the right financing strategy, you can maximize the potential of your Florida investment property and set yourself up for long-term success in this dynamic real estate market.

Burton Moreno, a passionate blog writer residing in the United States, blends his love for business, technology, and travel into captivating content. Based in a vibrant state, Burton brings a unique perspective to his readers, offering insights and experiences that inspire exploration and innovation.